Nationlink Settlement Policies and Procedures

1. Transactions passing through the Nationlink Network shall

be settled following the schedule below:

| Type of Transaction | Expected Settlement |

| Cash Withdrawal | Next banking day from transaction date |

| POS | Next banking day from transaction date |

| IBFT | Next banking day from transaction date |

| Bills Payment | Next banking day from transaction date |

| Monthly Billing | End of the month after the reference month |

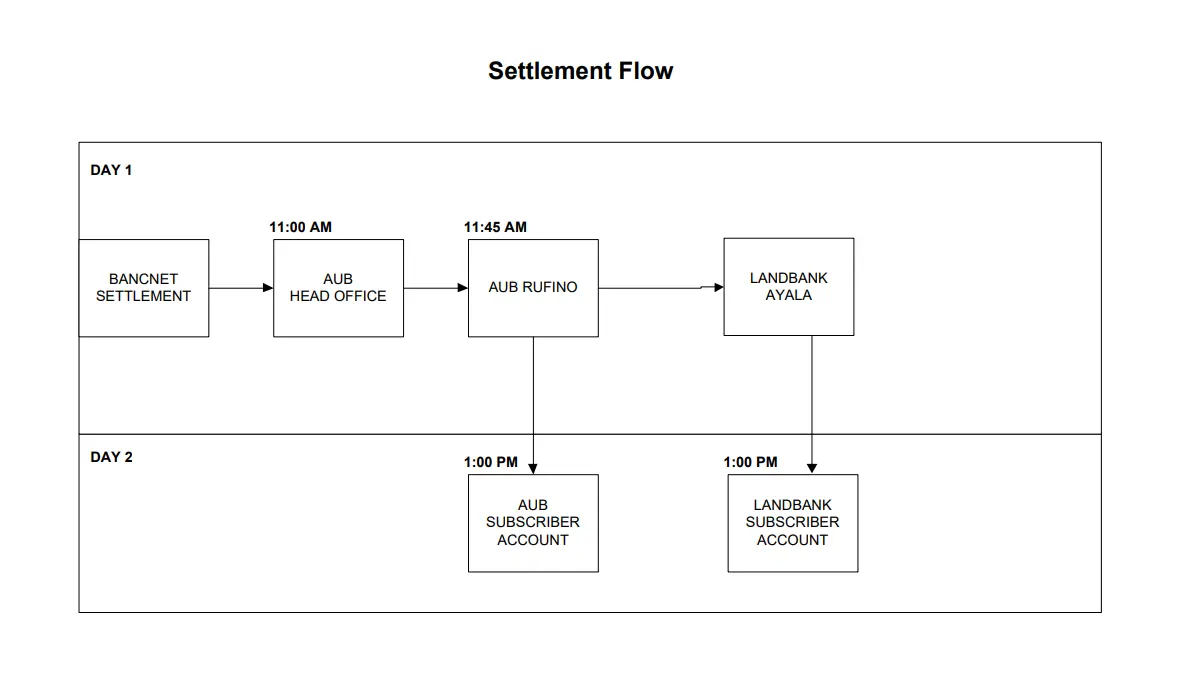

2. Upon receipt of the Daily Settlement Report from BancNet, the

Reconciliation Specialist shall reconcile the transactions using BancNet’s BARTS System.

Upon successful reconciliation, the Reconciliation Specialist shall conduct reconciliation of

Internetwork and Intranetwork transactions within the Nationlink Network.

3. The Reconciliation Specialist shall use the Nationlink

Acquirer and Issuer Summary Report (NAID) which contains issuer and acquirer transactions per

Nationlink Subscriber to match against the Daily Settlement Report provided by BancNet.

4. The Reconciliation Specialist will then create the Settlement

Working File to create the daily settlement report for Cash Withdrawal and POS transactions per

subscriber.

5. The Accounting Head shall review and approve the Settlement

Working File. Upon approval, the Settlement Report per Subscriber will be manually generated and

distributed to each subscriber.

6. On the next working day after the transaction date, the

Accounting Head shall instruct AUB – Rufino to do fund transfer based on the following:

| Source | Destination | Type of Transfer |

| AUB Rufino | Landbank – Ayala | Telegraphic Transfer |

| AUB Rufino | Metrobank – Ayala | Manager’s Check |

7. For the Monthly Billing, Nationlink will be settling to each subscriber by the end of each month after the reference month. The amount to be settled to each subscriber shall be added and included in the settlement report for each subscriber.